Raise Funds for SME with an IPO

Learn how to finance your business with an Initial Public Offering (IPO).

Discover the benefits of going public, what legal obligations

you must comply with in India,how to prepare for your IPO

We are here to empower small businesses by raising funds via SME IPO to help them grow.

IPO

OFS

Fixed Issue

Underwriter

Listing

Book-Building

Benefits of Going Public

Access to Capital

Going public can provide your business with an infusion of capital that can fuel growth, expansion, or acquisition.

Increased Visibility

Your company will become more visible to potential customers and partners, increasing brand recognition and credibility.

Liquidity for Founders

An IPO provides liquidity for the founders and early investors by allowing them to sell their shares on the open market.

Attracting Talent

Publicly traded companies are often able to attract and retain top talent by offering stock options as part of their compensation packages.

IPO Process for SMEs in India

🧑💻 Appoint a Merchant Banker

Your company must appoint a merchant banker to help with the IPO process, including drafting offer documents and filing with the Securities and Exchange Board of India (SEBI).

💼 Prepare Your Financials

You must prepare your financial statements and have them audited by a Chartered Accountant in accordance with the SEBI regulations.

📜 File Offer Documents with SEBI

Your merchant banker will submit offer documents on your behalf to SEBI for review and approval.

🤠 Set Price Band and Offer Shares

With the help of Merchant Banker the promoters can setup the price band as per demand in the market.

Legal Obligations for SMEs Post-IPO

Compliance with SEBI Regulations

Your company must comply with the various SEBI regulations, including reporting requirements, shareholder meetings, and disclosures.

Responsibility to Shareholders

Your company has a responsibility to its shareholders to maximize value and grow the business while maintaining transparency and ethical practices.

Corporate Governance

Your company is expected to maintain high standards of corporate governance, including independence of the board, investor relations, and integrity of financial reporting.

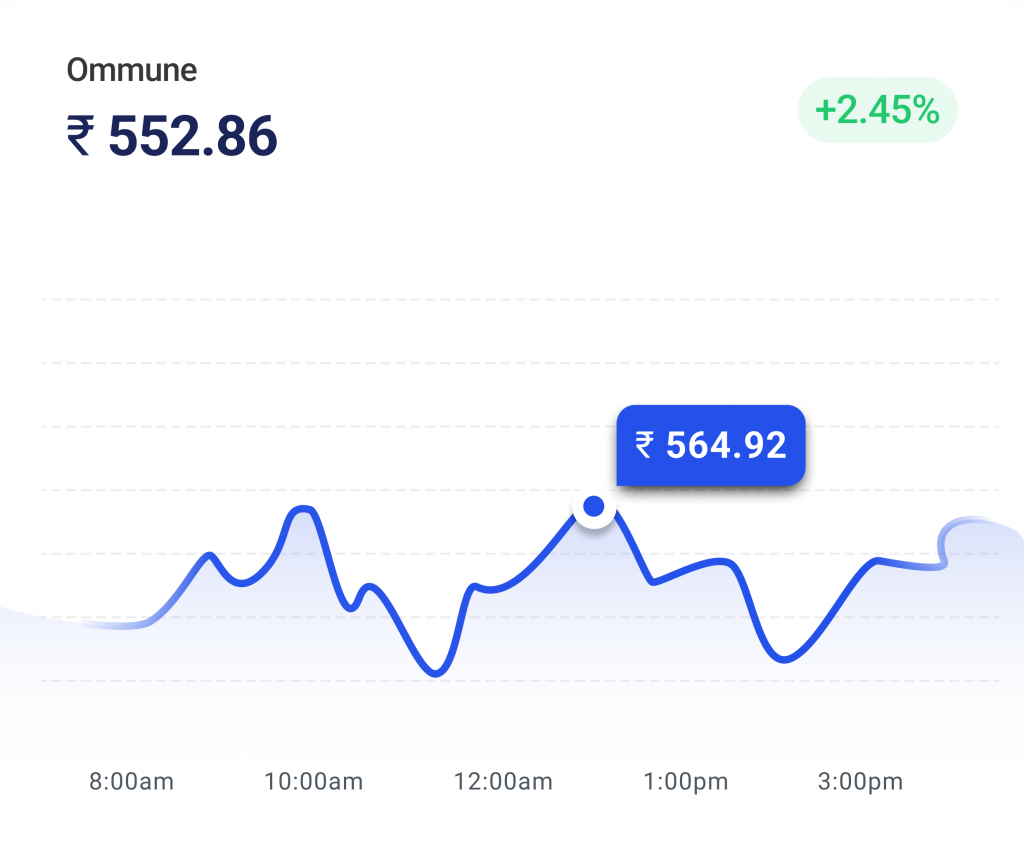

Market Volatility

Your stock price may be volatile due to market conditions, economic events, or company- specific news.

🌐 Listing on the Stock Exchange

Market Your IPO

Promote your IPO to potential investors through roadshows, advertisements, and public relations.

Allocate Shares

Allocate shares to institutional investors, retail investors, and HNIs (High net-worth individuals).

Pricing and Allotment

Determine the final price and allotment of shares to the investors.

Post-IPO Considerations and Next Steps

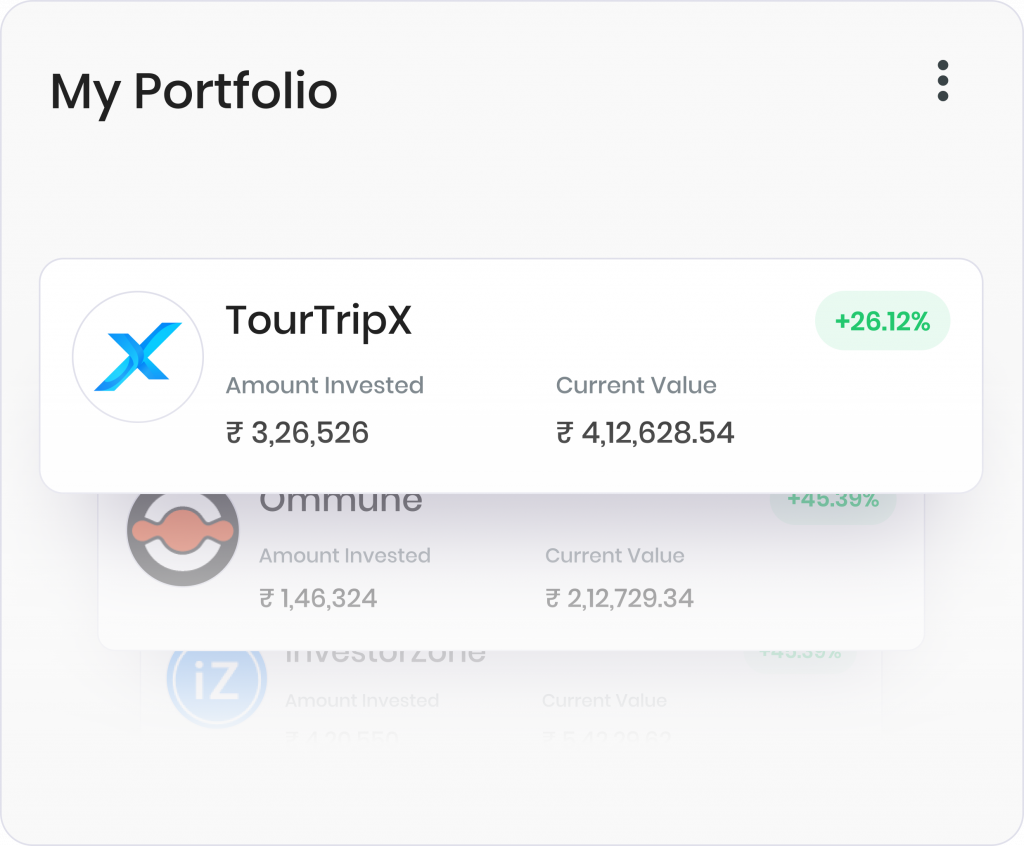

Create Investor Relations

Establish and maintain relationships with investors, analysts, and regulators. Maintain transparency and communicate regularly with investors.

Increase Your Stock Price

Maximize your stock price through effective financial management and strategic decision-making.

Explore Growth Opportunities

Explore new business opportunities, partnerships, or acquisitions that will contribute to the growth of your company.

Start Planning for Next Stage

Start planning for the next stage of your business, such as mergers and acquisitions, expansion into new markets, or technological advancements.

📖 Our Blogs

Organize Your Information

Your merchant banker will submit offer documents on your behalf to SEBI for review

Organize Your Information

Your merchant banker will submit offer documents on your behalf to SEBI for review

Organize Your Information

Your merchant banker will submit offer documents on your behalf to SEBI for review

Frequently asked questions

An SME IPO is an Initial Public Offering launched by a Small and Medium-sized Enterprise (SME) to raise capital from the public by issuing shares to investors.

Going public can provide access to a larger pool of capital and potential investors, which can help the SME raise funds for expansion, growth, or debt repayment. It also enhances the company’s visibility and credibility.

1.The post issue paid up capital of the company (face value) shall not be more than Rs. 25 crores.

2. Net Tangible Assets should be Rs 1.5 Crore.

3. The company or the partnership/proprietorship/LLP Firm or the firm which have been converted into the company should have combined track record of at least 3 years and out of 3 years, one year company should be profitable.

The IPO price is typically determined through a book-building process or a fixed price method. In the book-building process, the company and its underwriters set a price range, and investors bid for shares within that range. The final price is determined based on investor demand. In the fixed price method, the price is pre-determined by the company and its underwriters.

Underwriters like us are financial institutions that assist the SME in the IPO process. We help determine the IPO price, manage the issuance and allocation of shares, and support the marketing and distribution of the offering to potential investors

SMEs need to comply with specific regulatory requirements set by the stock exchange and regulatory authorities. This includes providing detailed financial statements, business plans, risk factors, and other disclosures in the prospectus

The IPO process duration can vary, but it typically takes 3M to 6M to complete. It includes preparation, due diligence, regulatory approvals, marketing, and final listing on the stock exchange.

SMEs will incur various expenses, including underwriting fees, legal fees, regulatory fees, marketing expenses, and stock exchange listing fees

Going public through an IPO will dilute the ownership stakes of existing shareholders, including founders and early investors. The minimum dilution required is 25%.

SMEIPOINDIA supports companies in raising funds through a comprehensive process. We begin by assessing the company’s financial health, growth prospects, and funding requirements while assisting in the preparation of essential documents, financial statements, and business plans to appeal to potential investors. Leveraging our vast network, we identify interested investors, venture capitalists, and private equity firms tailored to the company’s industry and growth stage. SMEIPO India then helps create a compelling pitch and presentation, showcasing the business idea, growth potential, and the benefits of investing in the company. Additionally, we provide expertise in determining a fair valuation for the company based on market conditions, financial performance, and growth projections. Through these steps, SMEIPO India aids companies in effectively raising the funds needed for their growth and success.